How Business Credit Cards Boost Travel Rewards, Even if You’re Not a Traditional Business Owner

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

When it comes to earning travel rewards, business credit cards might seem out of reach. If you’re thinking, “I don’t own a business, so I can’t apply for a business card,” you’re not alone. I used to feel the same way! But here’s the good news: you don’t need a registered business to qualify. In fact, opening business cards could be one of the easiest ways to supercharge your rewards. Let’s break it down.

Why Consider Business Credit Cards

Business credit cards come with unique benefits that make them a no-brainer for rewards travelers:

- High Welcome Offers: Business cards often feature generous sign-up bonuses that help you rack up points faster.

- No Impact on the 5/24 Rule: Most business credit cards (except some from Discover and Capital One) don’t count toward Chase’s 5/24 rule. This means you can maximize your personal cards while still opening business cards.

Who qualifies for a business credit card?

Here’s the secret: if you earn money outside a regular W-2 job, you’re likely eligible for a business card. Whether it’s a side hustle, freelance work, or selling items online, you could qualify as a sole proprietor.

Examples of Qualifying Activities:

- Selling on platforms like eBay, Etsy, or Facebook Marketplace – typically the easiest for anyone who has kids. You can sell some of their gently used clothes or toys online, and now you have a business. A friend of mine’s husband sells baseball cards online to qualify.

- Babysitting or daycare

- Tutoring or teaching

- Renting out property (like Airbnb-ing your own home or a second home)

- Driving for rideshare apps like Lyft and Uber or food delivery apps like Door Dash

- Freelancing (writing, graphic design, etc.)

How to Apply for a Business Credit Card

Applying is simpler than you might think. Here’s how to navigate the key application sections if you’re applying as a sole proprietor (meaning you do not have an EIN aka employer identification number):

- Legal Name of Business: Use your full name.

- Business Name on Card: Same as above.

- Business Address: Your personal address.

- Business Structure: Select “Sole Proprietor.”

- Tax ID: Use your Social Security number (SSN).

- Annual Business Revenue: Estimate what you’ll earn this year, even if it’s a side hustle.

- Years in Business: Include all the time you’ve been doing this activity, even if you weren’t earning much at first.

- Employees: Enter “0” or “1,” depending on the application requirements.

Pro Tip:

To increase your approval odds, space out applications by at least 90 days and ensure you’re not opening too many cards too quickly. If you do happen to have an EIN, use that to apply instead of your SSN.

Can you use business cards for personal spending?

While business cards are intended for business expenses, banks can’t easily distinguish between personal and business spending. That said, keeping a clear record of expenses is crucial, especially for tax purposes. For tax time, you can easily categorize which of your purchases are business versus personal with apps like Rocket Money. But it’s important to note that the items you actually buy with your business card will not impact your ability to earn the sign up bonus, as long as you spend the required amount within the required time frame when you applied.

Can you open multiple business cards?

Yes! You can:

- Open multiple cards for a single business.

- Apply for new cards if you run different businesses, even as a sole proprietor.

For example, if you blog and sell items online, you could apply for the same card under each business, potentially earning twice the points!

Recommended Business Cards for Rewards Travel

Chase’s business credit cards have always been our top picks because of their flexibility, valuable rewards structures, and compatibility with the Ultimate Rewards® program, making them ideal for earning travel points. Here’s a deeper look to help you choose the right one for you:

- Benefits: Earns 1.5% cashback on all purchases with no categories to track, making it simpler to earn more points. It’s great to have a card like this in your wallet for spending categories where there isn’t an option to multiple your points (example: some cards earn 3x points in dining, but maybe you don’t have a card that earns extra points on groceries, so instead of using any old card that would get you the standard 1% back on “everything else”, you’d use this card to get 1.5%).

- Who Should Use It: Small businesses with varied spending or those new to rewards cards.

- Bonus: Cashback can be converted to Ultimate Rewards® points when paired with a premium card (Chase Sapphire Preferred®, Chase Sapphire Reserve®, or Ink Business Preferred®). No annual fee.

- Benefits: Offers 5% cashback on office supplies, phone, and internet services, and 2% cashback at gas stations and restaurants—all with no annual fee. One of the top ways to use that 5% cashback at office supply stores is to buy gift cards for places where you may be spending a lot but can’t earn many points back, like Amazon or Airbnb, which don’t typically fall neatly into a bonus category. You can also use this to buy gift cards as presents for others and get 5% back.

- Who Should Use It: Entrepreneurs or side hustlers with significant spending in these categories, or those with an office supply store in convenient distance to your home, so you can snag gift cards at 5% back to use on your every day purchases.

- Bonus: Points can also be transferred to travel partners when paired with a premium Chase card (Chase Sapphire Preferred®, Chase Sapphire Reserve®, or Ink Business Preferred®). No annual fee.

- Why It’s Great: Gives you the ability to transfer points to premium travel partners, plus 3X points on travel and other business categories like shipping and advertising. This is a great card to use on your random travel expenses if you don’t already have a Chase Sapphire Preferred®, which already earns 3X points on travel.

- Who Should Use It: Established businesses or those prioritizing travel redemptions.

- Bonus: Includes trip protection, cell phone insurance, and other premium benefits, but note that this card does have a $95 annual fee.

These cards offer powerful earning potential, flexibility, and family-friendly rewards, making them a go-to choice for maximizing points.

Why Chase over Amex or Capital One?

- Transfer Partners: Chase points transfer to popular programs like Hyatt and Southwest, often with better redemption value than Amex or Capital One.

- Ease of Use: Chase’s rewards ecosystem is straightforward, and its cards offer a variety of no fee options for beginners.

- Versatility: With no cap on cashback categories and flexible redemption, Chase business cards fit a range of budgets and spending habits.

- Lower Required Spending: Chase business cards typically have a lower requirement for spending to earn their sign-up bonuses, making them easier to achieve for families with their regular household spending.

How to Maximize Points

If you hold a Chase business card, you’ll need to combine your points onto a premium card like the Chase Sapphire Preferred® or Ink Business Preferred® to transfer them to travel partners. Here’s how:

- Log into your Chase account.

- Navigate to “Ultimate Rewards.”

- Select “Combine Points” and choose the cards you want to transfer between.

- Points transfer instantly!

You can also combine points with one other household member after linking accounts by calling Chase directly.

How to Combine Points

Step 1

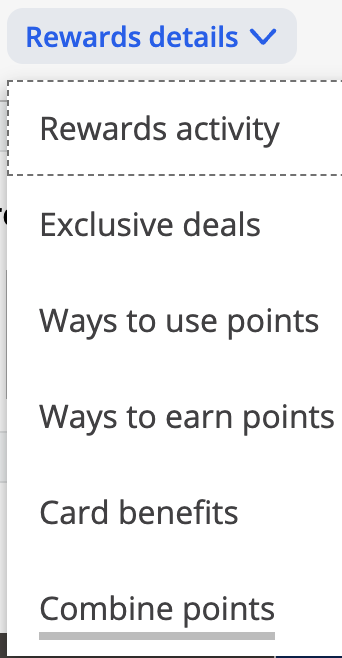

Combine points from different cards by logging into your Chase account and click Ultimate Rewards® under Rewards on the right side. Once in the Ultimate Rewards® section, select “Rewards details”, then “Combine points” on the navigation.

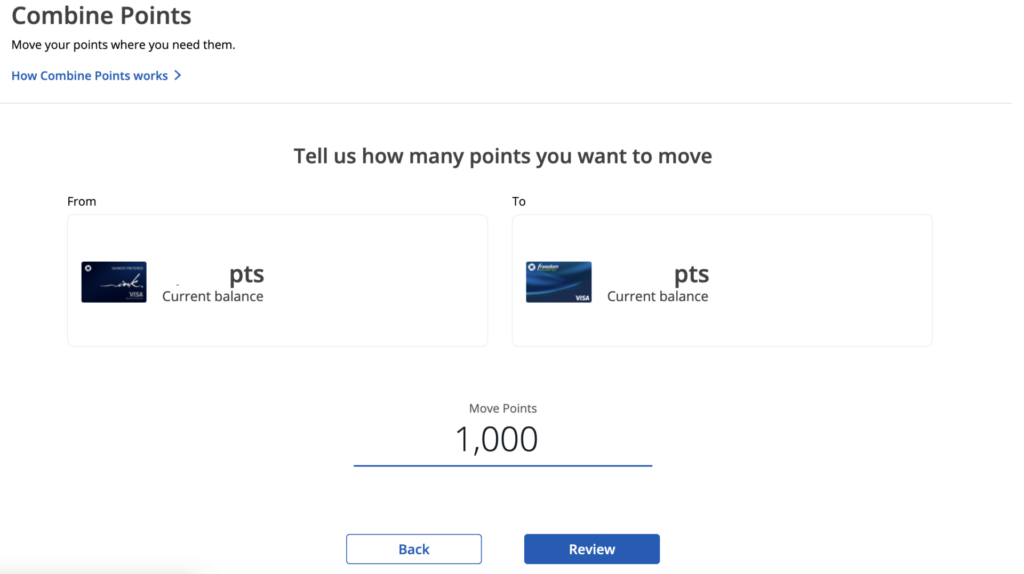

Step 2

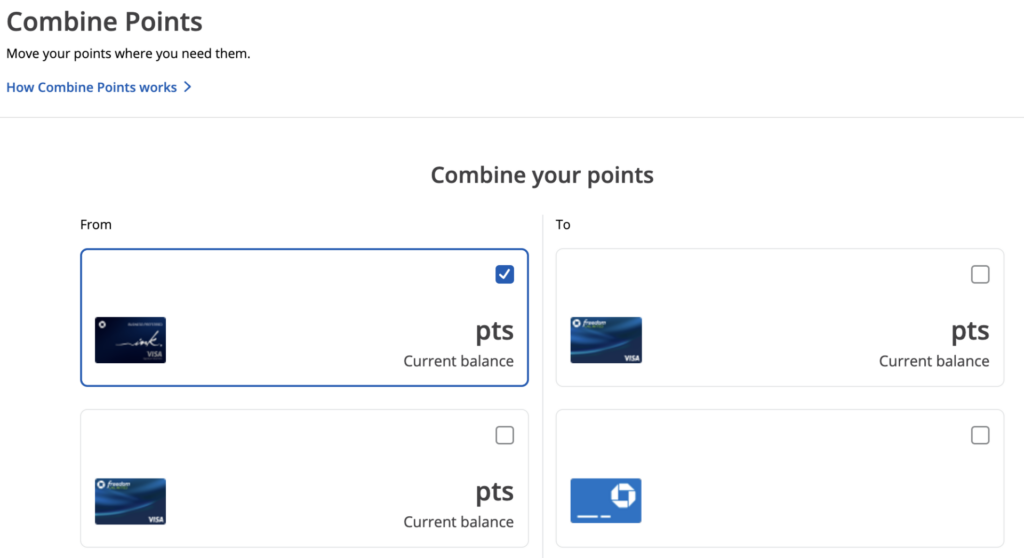

Then, select the card from which you want to move points, and the card to which you want to move points. The number of points and names of the cards have been erased in the below examples, but yours will show your card names over the images, with the last four digits displayed, in addition to how many points you have to move. Keep in mind that you want to move your points to a card that earns Ultimate Rewards® points from a cashback card in order to redeem them for travel.

Step 3

Manually type in how many points you want to move from one card to another.

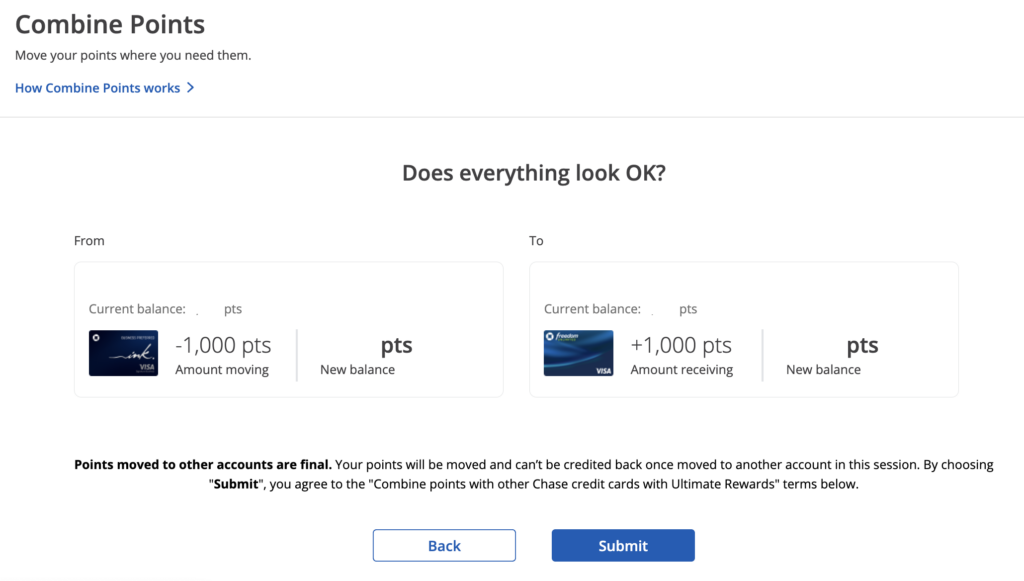

Step 4

Confirm that everything looks good before hitting submit. Your points should combine instantly.

Stretching Your Travel Budget

Business cards let you alternate between earning on personal and business cards, helping you maximize bonuses while staying under Chase’s 5/24 rule. With a little planning, you can collect hundreds of thousands of points each year to stretch your travel budget further. Just remember to always space out your applications by at least 90 days to keep your credit score healthy, and pay off your balance in full each month. We use autopay to ensure this happens.

Final Thoughts

Opening business cards isn’t as intimidating as it seems, and it’s also not “against the rules”. Whether you’re selling a few items online or offering freelance services, you’re likely eligible—and the rewards can be incredible. So, why not take the leap? Start earning points to fuel your next adventure and unlock the full potential of travel rewards.

If you have any questions or need further advice feel free to email me or send me a message on Instagram. I’m always happy to share more tips and insights to help you improve your family’s travel budget.

Please note that this article contains affiliate links, and I may earn a referral commission if you choose to apply through my links. As a small business, these earnings help me to continue to bring you content like this at no extra cost to you. Thank you!

-

How to Prepare Toddlers for New Experiences

Learn how to Prepare Toddlers for New Experiences with simple scripts, visuals, and role play so family trips, new routines, and big changes feel calmer.

-

5 Must-Have Beach Essentials for Toddlers

Keep beach days simple and fun with these 5 Beach Essentials for Toddlers, including safety gear, sun protection, toys, and snacks to keep little ones happy.

-

5 Genius Toddler Flight Essentials

Whether you’re flying across the country or just hopping to grandma’s house, the right toddler flight essentials can turn a stressful travel day into something that actually feels manageable. After many flights with our boys at different ages and stages, we’ve learned that a little planning up front goes a long way in keeping everyone…