The Chase Sapphire Preferred® Card: The Ultimate Family Travel Tool We Love

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

The Chase Sapphire Preferred® Card is the perfect starter card for families looking to dive into the world of rewards travel. It offers easy-to-use benefits, flexible points, and exceptional transfer partners that make it ideal for family vacations. It was the first card that my husband and I both opened when we started out as rewards travelers, and we both still hold it in our wallets today! Here’s why it’s the card you need in your wallet.

Chase Sapphire Preferred Overview

The Chase Sapphire Preferred® typically offers a generous 60,000-point bonus after spending $4,000 in the first 3 months. With a reasonable $95 annual fee, it packs in powerful perks that make it one of the most beginner-friendly cards for earning travel rewards.

To earn the 60,000-point sign-up bonus on the Chase Sapphire Preferred® Card, you need to spend $4,000 on the card within the first 3 months of opening the account. Once you reach this spending threshold, the points will be credited to your account. At our house, we strategically move our regular household spending to meet minimum spend requirements without overspending. I never recommend spending money you don’t already plan to spend just to earn a bonus, as this could lead to unnecessary debt.

On occasion, Chase will offer an elevated sign up bonus for the Sapphire Preferred® card, which historically has sometimes gone as high as 75,000-100,000 points. You can always call or stop in to a branch to find out what the current offers are, which can some times differ depending on your relationship with the bank.

Benefits Tailored to Families

The card offers a $50 hotel credit when you book through the Chase Travel℠ portal, which is great for family trips. Plus, you’ll earn:

- 5X points on travel booked through Chase Travel℠ (perfect for family flights and accommodations),

- 3X on dining (ideal for those family restaurant outings or even ordering takeout),

- 2X on other travel (like gas, rideshares, or car rentals),

- 1X on all other purchases

When you book travel through Chase, you also get a 25% boost in the value of your points. This means your 10,000 points become worth $125, making it even easier to plan your next getaway.

What Does X Points Mean?

The “X” refers to how many points you earn per dollar spent in a specific category.

- 5X points: Earn 5 points for every $1 you spend.

- 3X points: Earn 3 points for every $1 you spend.

- 2X points: Earn 2 points for every $1 you spend.

- 1X points: Earn 1 point for every $1 you spend.

Examples in Action

Here’s how many points you’d earn on $100 spent in different categories:

- Dining (3X points): Spend $100 at a restaurant, and you’ll earn 300 points.

- Calculation: $100 x 3 = 300 points.

- Travel booked through Chase Travel (5X points): Spend $100 on a flight, and you’ll earn 500 points.

- Calculation: $100 x 5 = 500 points.

- Other travel, like gas or rideshares (2X points): Spend $100 on gas, and you’ll earn 200 points.

- Calculation: $100 x 2 = 200 points.

- All other purchases (1X point): Spend $100 on groceries, and you’ll earn 100 points.

- Calculation: $100 x 1 = 100 points.

Point-to-Dollar Ratio

When redeeming your points, the value depends on how you use them:

- Standard Redemption: Points are typically worth 1 cent per point when redeemed for cash back, gift cards, or basic travel.

- Example: 10,000 points = $100.

- Travel Through Chase Portal (25% Boost): If you redeem points for travel using a card with a 25% boost (e.g., Chase Sapphire Preferred), each point is worth 1.25 cents.

- Example: 10,000 points = $125.

- Transferring to Travel Partners: The value can vary but often exceeds 2 cents per point, depending on how strategically you book.

- Example: 10,000 points could be worth $200 or more for plan tickets or hotels.

This flexibility makes earning and redeeming points a powerful way to maximize every dollar you spend!

What Are Chase Ultimate Rewards Points?

The Chase Sapphire Preferred card earns you what’s called Chase Ultimate Rewards points. Chase Ultimate Rewards points are some of the most versatile travel and cashback rewards you can earn. Here’s why they’re valuable:

- Flexible Redemption Options:

- Redeem points for travel, statement credits, gift cards, or merchandise.

- Travel Portal Bonuses:

- Get 25%–50% more value when booking travel through Chase’s portal with a Sapphire card.

- Transfer to Travel Partners:

- Convert points 1:1 to top-tier travel partners like United, Hyatt, and Southwest for incredible value.

- Cash Value:

- Redeem points as cash at a standard rate of 1 cent per point.

Whether you want to book a dream vacation, cover everyday expenses, or save for the future, Chase Ultimate Rewards points give you the flexibility to achieve your goals.

Built-In Travel Protection

The Sapphire Preferred® also offers essential travel protections:

- Trip Cancellation/Interruption Insurance: Protects your family in case your trip gets cut short.

- Auto Rental Collision Damage Waiver: Save money on car rentals, knowing you’re covered.

- Lost Luggage Insurance: If your luggage gets lost, you’ll have peace of mind knowing Chase has your back.

At least part of your trip must be booked using the Chase Sapphire Preferred card or your Chase Ultimate Rewards point for the trip to qualify for travel insurance benefits with a Chase. Eligible travel purchases include airline tickets, hotels, car rentals, cruises, activities, and tours.

Does Chase Sapphire Preferred Have Foreign Transaction Fees?

There are no foreign transaction fees, making this a perfect option for families while traveling abroad.

Eligibility

This card and rewards travel in general is ideally suited for those with good to exceptional credit, who can pay their bills on time each month, and can avoid getting into debit/manage a budget.

To apply for the Chase Sapphire Preferred® Card, you cannot currently hold any other Chase Sapphire card (including the Sapphire Reserve®). Additionally, if you’ve earned a bonus on either Sapphire card in the past 48 months, you won’t be eligible for another. However, if you’ve had the card but it’s been over 48 months, you can downgrade to a no-fee Chase card, like the Chase Freedom Flex® or Freedom Unlimited®, and reapply for the Sapphire Preferred® to earn the bonus again.

Why Chase Sapphire Preferred® Shines for Family Travel

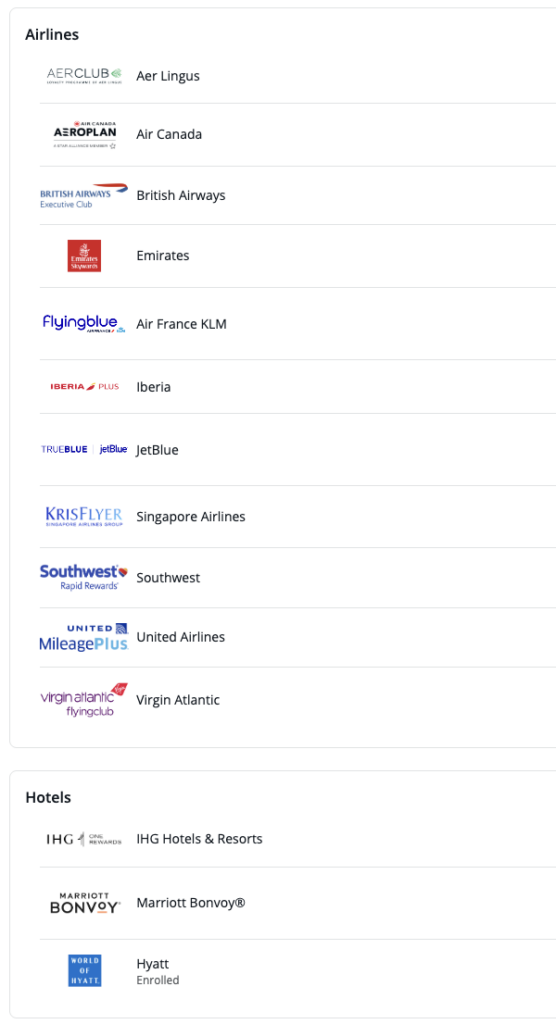

One of the key selling points of this card is its transfer partners. Chase has 11 airline and 3 hotel partners, all offering a 1:1 point transfer rate. This means you can transfer your points in increments of 1,000 to airlines like Southwest, United, and British Airways, or hotels like Hyatt, IHG, and Marriott—ideal for family trips, whether you’re visiting Disneyland, Hawaii, or exploring international destinations. Here is the full list of all of Chase’s current transfer partners:

With Hyatt, for example, you can book family-friendly hotels at excellent value since Hyatt’s point rates are generally lower than other hotel chains. Additionally, Chase has the advantage of offering domestic airline partners, like Southwest, which makes it easier for families to find flights that suit their schedules and budgets. This exact combination is how we traveled to Hawaii for almost two weeks for less than $100 total out of pocket for flights and hotels.

How to Transfer Points to Travel Partners

Step 1

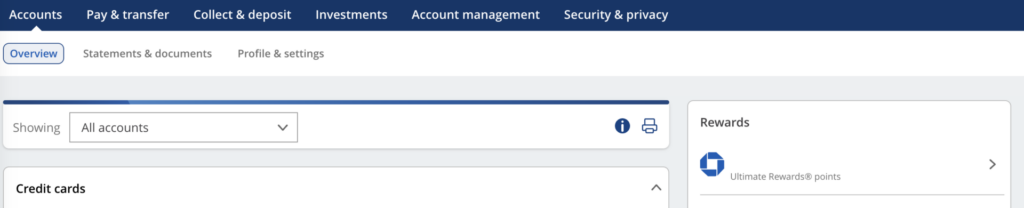

Log into your Chase account and click Ultimate Rewards® under Rewards on the right side.

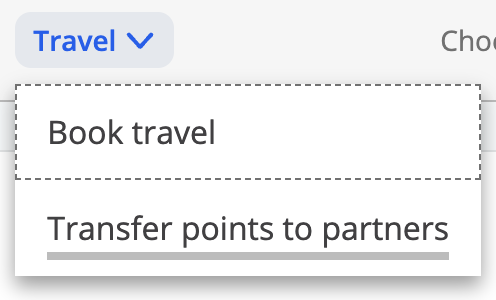

Once in the Ultimate Rewards® section, select “Travel”, then “Transfer points to partners” on the navigation.

Step 2

Scroll down to the partners section, and choose the partner to which you want to transfer points. For this example, we’re choosing Hyatt.

Step 3

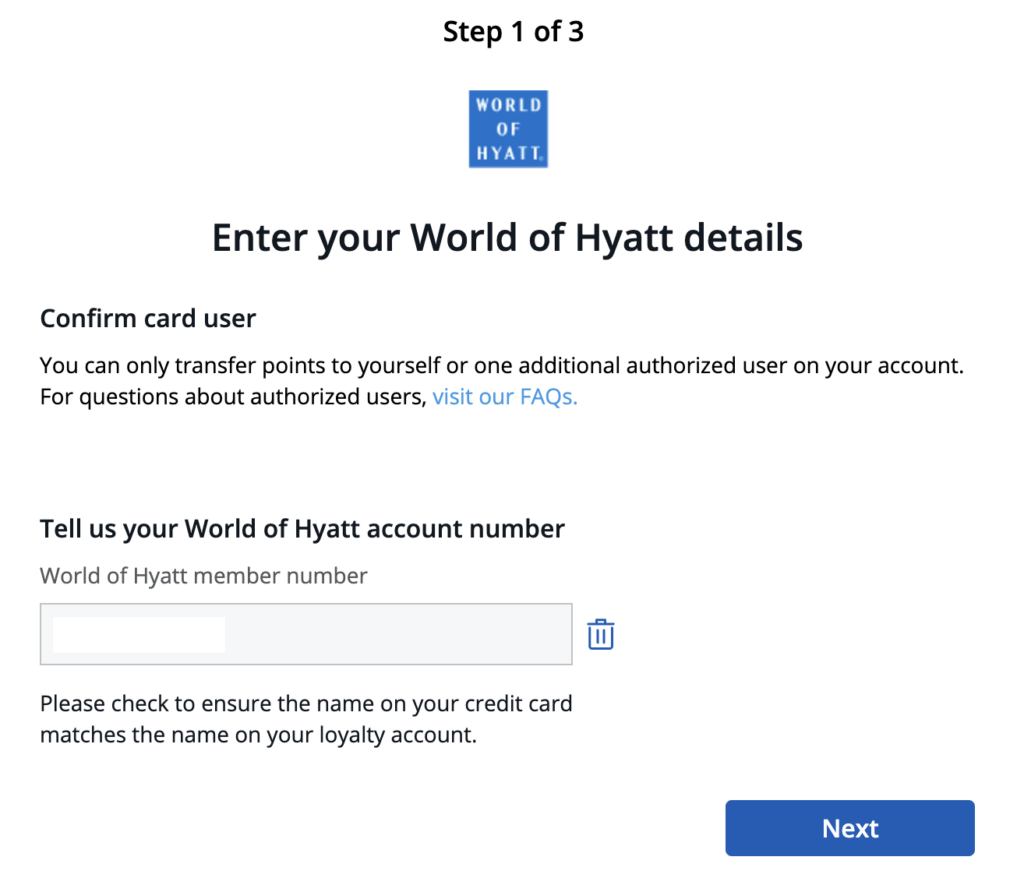

Enter the details associated with the membership of the partner you want to transfer to. Here, you will enter your World of Hyatt number. World of Hyatt is a free program to join, like frequent flyer numbers but for hotels.

Step 4

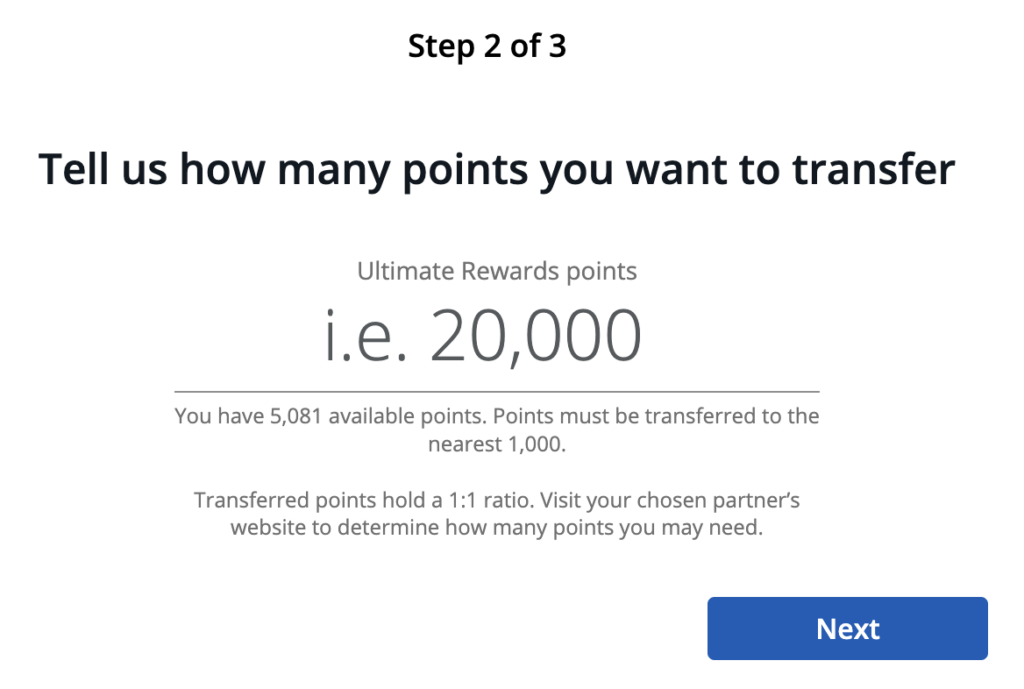

Enter how many points you want to transfer.

Pro tip: Always make sure you’ve found the flights or hotel rooms you want to book before transferring points—once they’re transferred, they’re locked into the partner’s program.

Step 5

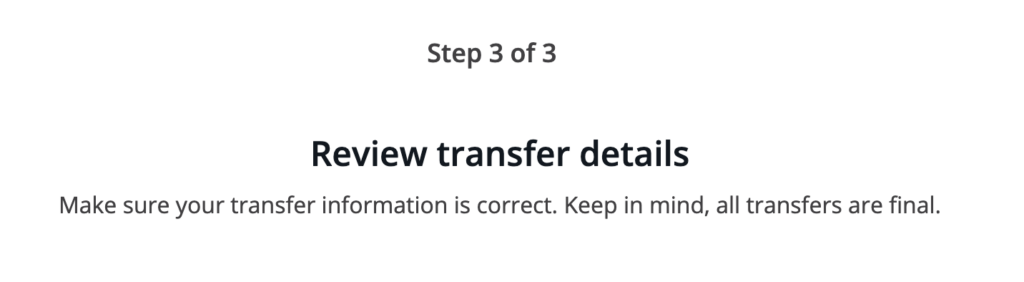

Review your transfer details before your submit.

Once you submit, it can take anywhere from instant to 72 hours for your points to appear in the partner account. If your points don’t transfer instantly, call the partner to get an idea of approximately how long it will take, so you know when to come back and book your travel.

Earning More Points and Combining

You can also combine points earned from other Chase cards to increase your rewards, if you hold certain Chase cards that allow for combining points.

Eligible Premium Cards for Combining Points

You need at least one of the following Chase cards to unlock the ability to combine and transfer points:

These cards allow points to:

- Be redeemed for a travel boost (e.g., 25%-50% more value in the Chase Travel Portal).

- Transfer to travel partners like United, Hyatt, or Southwest for outsized value.

If you have a Chase Freedom Flex®, Freedom Unlimited®, or any other Chase card that earns Ultimate Rewards®, you can still combine them with points earned on your Chase Sapphire Preferred card to use them for travel. I personally also hold the Chase Freedom Unlimited®, and I love that it offers 1.5% back on all purchases.

How to Combine Points

Step 1

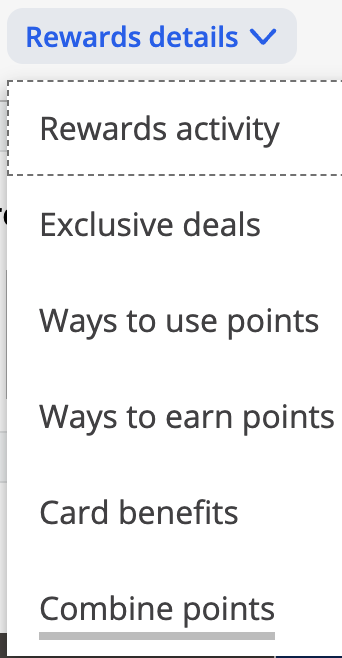

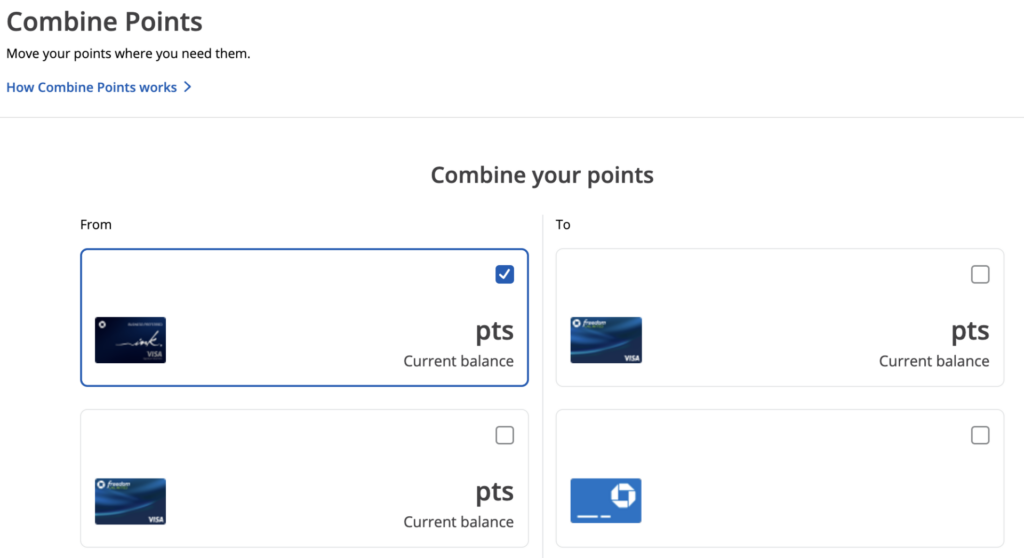

Combine points from different cards by logging into your Chase account and click Ultimate Rewards® under Rewards on the right side. Once in the Ultimate Rewards® section, select “Rewards details”, then “Combine points” on the navigation.

Step 2

Then, select the card from which you want to move points, and the card to which you want to move points. The number of points and names of the cards have been erased in the below examples, but yours will show your card names over the images, with the last four digits displayed, in addition to how many points you have to move. Keep in mind that you want to move your points to a card that earns Ultimate Rewards® points from a cashback card in order to redeem them for travel.

Step 3

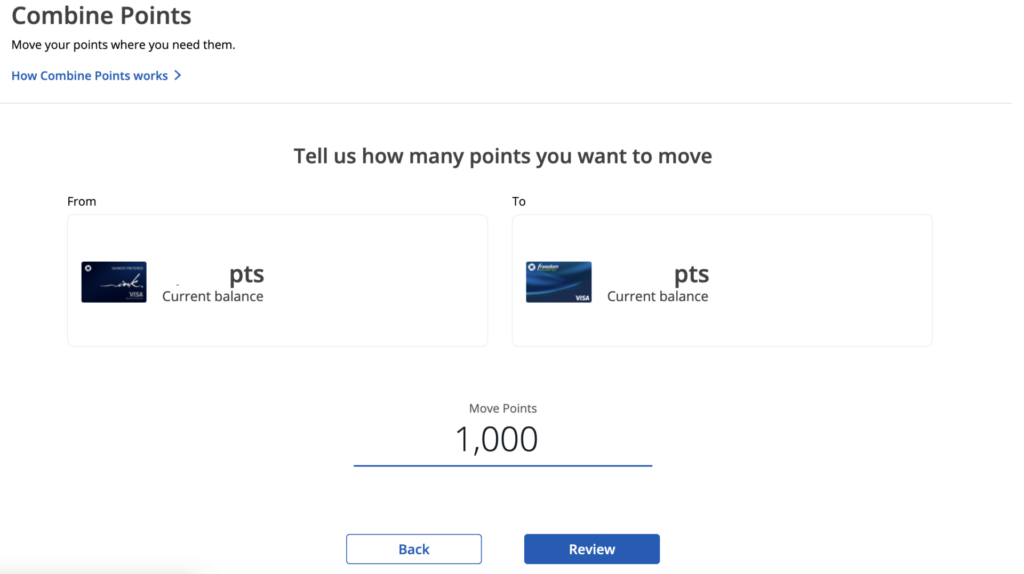

Manually type in how many points you want to move from one card to another.

Step 4

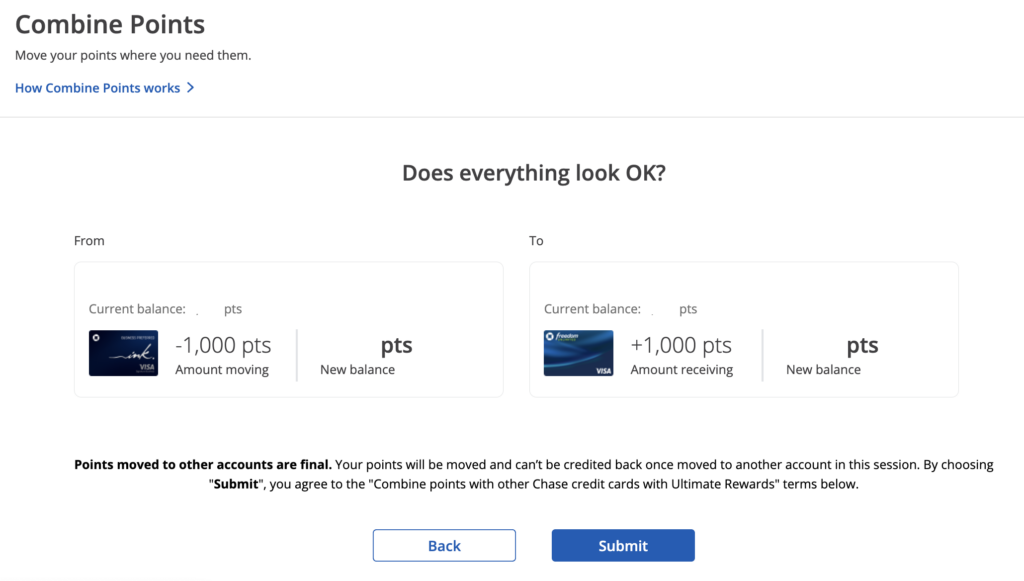

Confirm that everything looks good before hitting submit. Your points should combine instantly.

Cards That Earn Ultimate Rewards Points

In addition to the Chase Sapphire Preferred, these cards give you Chase’s most versatile and valuable rewards, known as Ultimate Rewards points. They’re flexible and can be used for travel, cash back, or transferred to travel partners for outsized value.

- Chase Sapphire Reserve®

- Earn 10x points on hotels and car rentals booked through Ultimate Rewards, 3x on travel and dining, and 1x on all other purchases.

- Chase Freedom Flex℠

- Earn 5x points on rotating categories (up to $1,500 per quarter), 3x on dining and drugstores, and 1x on everything else.

- Chase Freedom Unlimited®

- Earn 1.5x points on all purchases, plus 3x on dining and drugstores.

- Ink Business Preferred® Credit Card

- Earn 3x points on travel and certain business categories, and 1x on all other purchases.

- Ink Business Unlimited® Credit Card

- Earn 1.5x points on all purchases.

- Ink Business Cash® Credit Card

- Earn 5x points on office supply stores and utilities, 2x at gas stations and restaurants, and 1x on everything else.

Some Chase cards don’t earn Ultimate Rewards points directly. Instead, they earn cash back or partner-specific rewards. Some also come with annual fees, so make sure to check that the card benefits outweigh the fee costs for your family.

Final Thoughts

The Chase Sapphire Preferred® is one of the most versatile and valuable cards for families looking to earn travel rewards. From easy point transfers to incredible travel perks, this card will help you save money and make unforgettable memories on family vacations.

Not sure if this or another card could be right for you? Sign up here for a free credit card consultation with me, and we’ll help you find your next best rewards travel card.

If you have any questions or need further advice feel free to email me or send me a message on Instagram. I’m always happy to share more tips and insights to help you.

Please note that this article contains affiliate links, and I may earn a referral commission if you choose to apply through my links. As a small business, these earnings help me to continue to bring you content like this at no extra cost to you. Thank you!